Auditing

Latest News

Zone & Co Launches ZoneBilling AI Assistant

IRS Extends Tax Deadlines Until May For Helene Victims

Avantax Acquires SEP Financial Services

Sovos Launches Indirect Tax Suite for SAP, Enhances Clean Core Readiness

Salaries on the Rise for Accounting Professionals

To handle new business, public accounting firms are looking to add to their workforce. Many still need to fill positions left vacant during the downturn and take some of the burden off their current teams.

IRS to Miss Goal for Homeland Security Directive on Security

The Internal Revenue Service (IRS) will not meet the Department of the Treasury’s 2015 goal for full compliance with a directive requiring Federal agencies to issue identification cards that allow workers to gain access to Federally controlled facilities

Tommye Barie Elected to Serve as Chair of AICPA

Tommye Barie, CPA, is the new chair of the board of directors of the American Institute of CPAs, the world’s largest member organization representing the accounting profession.

Special Report Focuses on New Financial Statement Preparation, Compilation and Review Standards

The report provides an overview of the AICPA’s Accounting and Review Services Committee’s new standard, which clarifies and revises the Statements on Standards for Accounting and Review Services (SSARS).

James Brown, CPA, Honored for Long Service to Accounting Profession

Indiana Certified Public Accountant (CPA) James L. Brown has been named the winner of this year's Sustained Contribution Award by the American Institute of CPAs (AICPA). The award recognizes members who have contributed measurably to the AICPA ...

Report: IRS Field Collectors Need to Focus on Cases with Better Potential

The IRS field workload selection process is not designed to ensure that cases with the highest collection potential are identified, selected, and assigned to be worked, according to a new report.

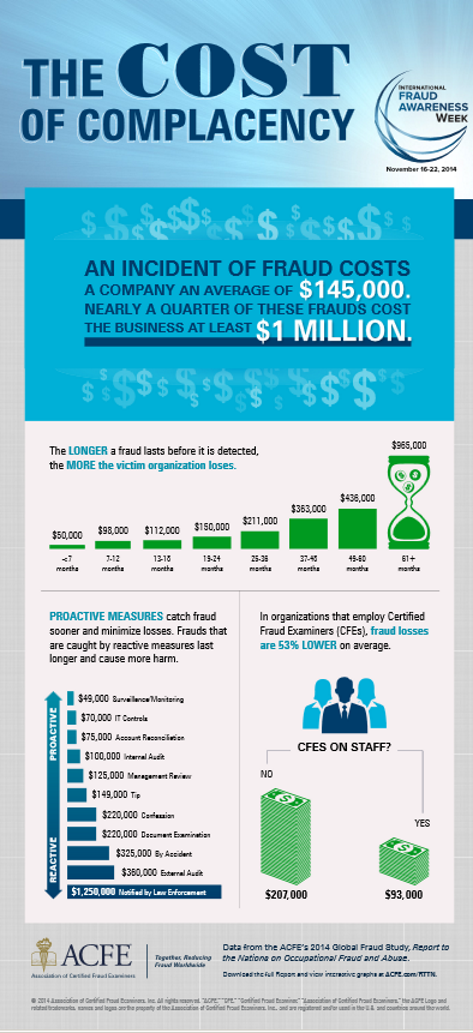

Fraud and the Cost of Complacency

Fraud costs businesses billions directly, but what is the cost of complacency? Research conducted by the Association of Certified Fraud Examiners (ACFE), the world’s largest anti-fraud organization, indicates that the longer a fraud lasts before it is ...

5 Tips to Help Small Businesses Reduce Risk of a Tax Audit

One of the most nerve wracking aspects about tax season for millions each year is the possibility of being audited. For small business owners and those who are self-employed, the chance of being audited is even greater.