Taxes

How to Prepare for the Corporate Minimum Tax

A corporate alternative minimum tax (CAMT) will apply to certain corporations reporting more than $1 billion in annual adjusted book income averaged over a three-year period...

Jan. 09, 2023

By: Tifphani White-King.

The Inflation Reduction Act, signed into law by President Biden on August 16, 2022, includes a range of measures intended to support climate and healthcare initiatives. To help fund these programs, the new law introduces various tax schemes.

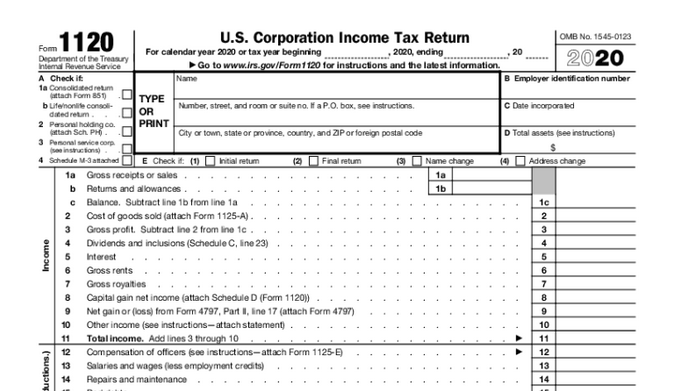

Notably, a corporate alternative minimum tax (CAMT) will apply to certain corporations reporting more than $1 billion in annual adjusted book income averaged over a three-year period. Effective December 31, 2022, these corporations will have to pay the greater of these two amounts: 15% of their adjusted financial statement income or their regular U.S. federal income tax added to their base erosion anti-abuse tax.

Thanks for reading CPA Practice Advisor!

Subscribe for free to get personalized daily content, newsletters, continuing education, podcasts, whitepapers and more...

Already registered? Login

Need more information? Read the FAQ's

The new law also imposes a 1% excise tax on “covered corporations” on the fair market value of stocks repurchased from shareholders during a given taxable year. A covered corporation is any domestic corporation whose stock is traded on an established securities market. The excise tax is subject to certain exceptions for buybacks, including those treated as a dividend, contributed to a retirement fund, that total less than $1 million or are transacted by regulated investment companies or real estate investment trusts.

These and other extensive changes to the U.S. corporate tax regime introduced by the Inflation Reduction Act will require comprehensive planning and modeling by organizations to truly understand their full impact.

How can businesses prepare

Corporations in the group that are subject to the CAMT should not wait for additional guidance to begin modeling their adjusted financial statement income tax exposure. The first step should involve taking a step back and evaluating your corporation’s tax business strategy from a holistic view. Corporations should start by seeking to answer questions such as: Based on our current strategy and structure, how will the provisions of the Act impact our business? What is our effective tax rate today, and what will it look like in the future?

Modeling for various scenarios – double taxation, taking advantage of new tax credits and incentives, conducting buybacks versus paying dividends – is key to truly understanding how the CAMT will affect your corporation. Organizaitons should have already started these modeling exercises to provide ample time to devise any changes necessary to optimize your potential tax exposure.

This exercise helps corporations identify areas of concern where additional guidance may be needed. Gathering secondary and tertiary opinions from multiple service providers to understand the number of prevailing options that exist and how the impact of CAMT will impact your business in the next year, or even the next ten years, can help organizations best model out every iteration or scenario.

Role of service providers

Navigating the alternative minimum tax may look different to various corporations as it relates to their overall corporate strategy. The role of a service provider is to ask prompting questions that reveal the current financial position of an organization, to nail down its overall goal or vision and efficiently advise.

Service providers will find that corporations may be at various planning stages – some may have already planned their books for the minimum tax liability, while others may be seeking advice on how to effectively model their business strategy. In order to provide paramount advice to a corporation, service providers will need to have a thorough understanding of the future business and operational ambitions of their clients in order to successfully map out the pathway of how to get there.

There are several new concepts introduced by the Inflation Reduction Act, all of which will impact corporations differently. By gathering opinions from various service providers, your organization can be best prepared to model out every iteration.

====

Tifphani White-King is the International Tax Services Practice Leader for Mazars USA. She has nearly 20 years of tax experience, providing operational, strategic, and marketplace direction for emerging, mid-market, and large multinational companies. Her expertise includes international tax structuring, transaction planning, mergers and acquisitions, tax provision, compliance reporting, and other related services.