BNA Software – BNA Income Tax Planner

Oct. 06, 2011

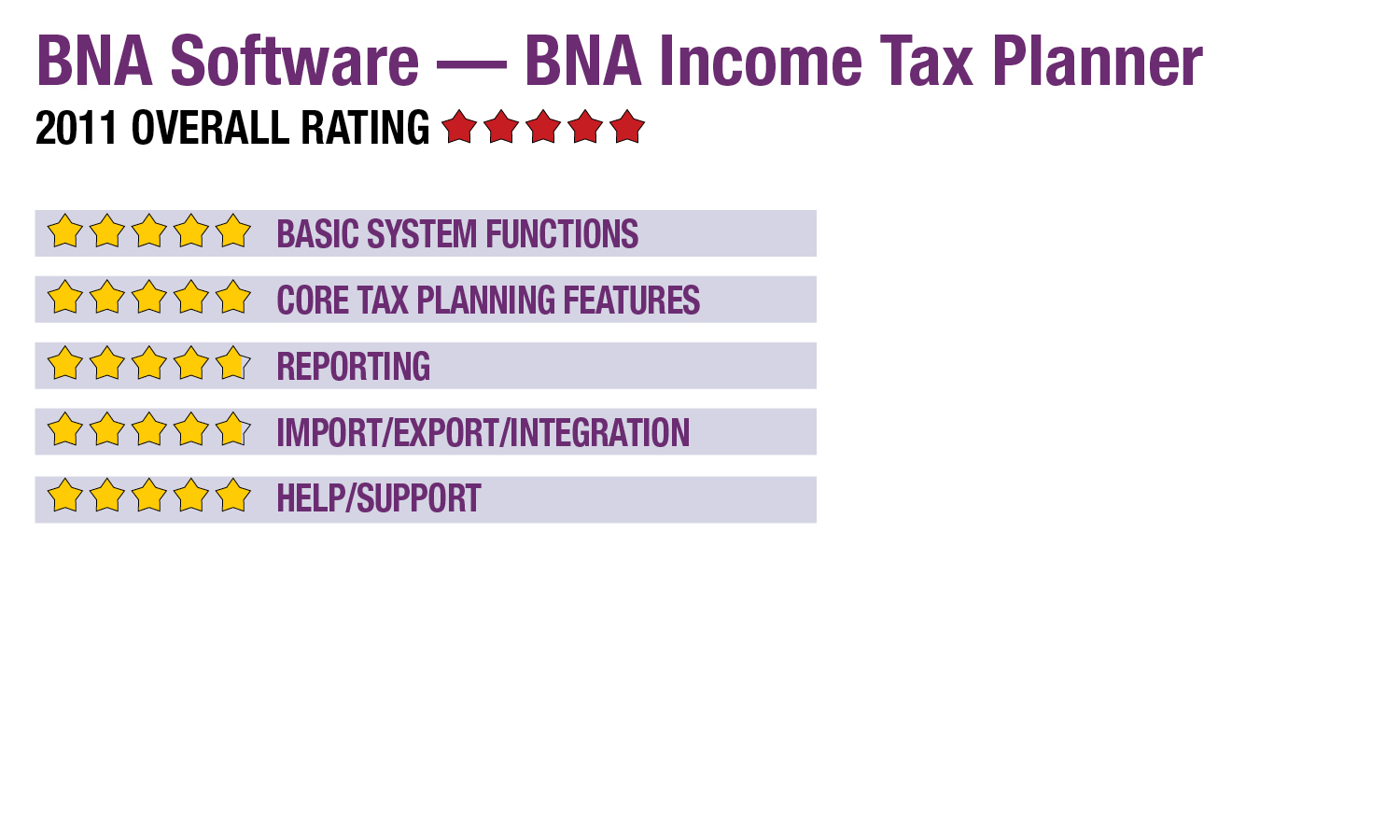

2011 Overall Rating 5

Best Fit

Practices offering individual income tax planning services to clients with varying needs, up to and including high net worth individuals with significantly complex income channels and assets.

Strengths

- Intuitive interface & navigation

- Comprehensive tax calculations & analyses

- Up to 20 side-by-side comparisons

- Excellent reporting & graphical customization

- Data integration with top tax compliance systems

Potential Limitations

- BNA doesn’t offer 1040 compliance

Summary & Pricing

BNA Income Tax Planner provides an easy-to-use, yet comprehensive planning system that can handle most any individual taxation scenario. The program also offers support for all income taxing states, and has useful client communication features. It is exceptionally suited to firms with complex and high net worth clients. Pricing for the base federal system starts at about $600.

Product Delivery Methods

_X_ On-Premises

___ SaaS

___ Hosted by Vendor

Basic System Functions 5

Core Tax Planning Features 5

Reporting 4.75

Import/Export/Integration 4.75

Help/Support 5